The billboard project is expanding to Oregon

Northern Nevada Native opponents of the proposed Thacker Pass lithium mine gather at the massacre site periodically to manifest their defense of ancestral lands. Photo by Tanya Novikova

The conflict between Lithium Americas Corp. and tribes opposed to strip mining at Thacker Pass is a bellwether. It foreshadows widespread turmoil over policymakers’ rush to prop up the electric vehicle industry.

In Washington’s overdue response to the climate crisis, the move to vanquish tailpipe emissions is a priority. Producing the batteries that motor the transition to the new transport mode is the challenge. Native critics and analysts weigh the policy directive against the swollen demand it creates for lithium and other raw materials.

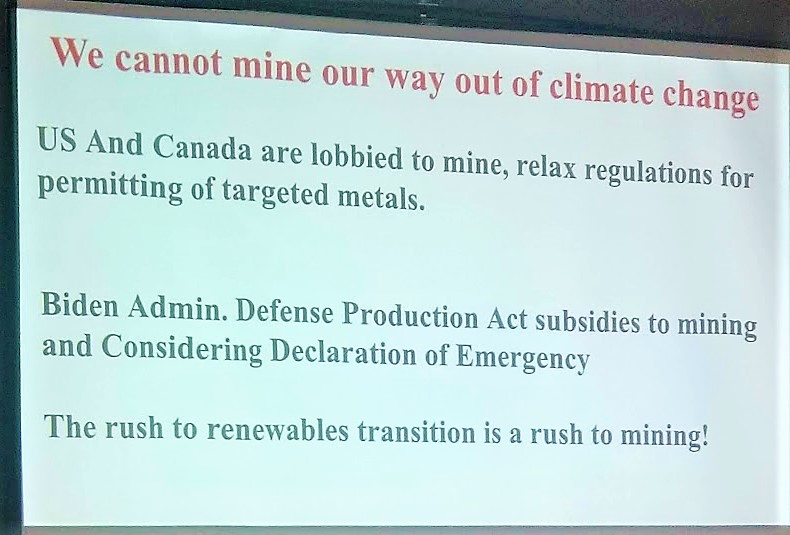

“We can’t mine our way out of a climate crisis. That’s our slogan,” says Reno-Sparks Indian Colony Tribal Historic Preservation Officer Michon Eben. “You cannot have a massive mine like this and think that is going to be good for the earth because it’s not. The lies that are being told about electric vehicles are not appropriate.”

Indigenous culture carriers maintain that the route to climate justice runs the other way. Instead of promoting more cars and consuming additional resources, the government should incentivize lighter modes of travel and accessible mass transit systems. “All the world’s Indigenous peoples are fighting extractive companies because it is destroying our water and our land and our resources and who we are as Natives,” Eben says.

Among the key energy-transition metals, the majority of U.S. lithium, nickel, copper, and cobalt reserves are located within 35 miles of Native American reservations. Analyst Samuel Block at the New York-based MSCI finance consultancy warns investors that “culturally significant areas are not limited to reserved lands.”

In an essay entitled “Mining Energy-Transition Metals: National Aims, Local Conflicts,” he writes, “Not only could local cultures be at risk, but investors too. Local opposition increases risks that a mining asset could lose its license to operate and its value to investors.”

On Feb. 21, four non-profits filed an emergency motion to “block ground disturbance and construction” at Thacker Pass pending an appeal in U.S. Circuit Court. Great Basin Resource Watch, Western Watersheds Project, Basin and Range Watch, and Wildlands Defense are contesting a lower court ruling. Made earlier in the month, that decision partly validated the federal Bureau of Land Management’s permit to mine Thacker Pass.

“All the world’s Indigenous peoples are fighting extractive companies because it is destroying our water and our land and our resources…”

Michon Ebon, Reno-Sparks Indian Colony Tribal Historic Preservation Officer

Paiute, Shoshone, Bannock, Washoe, Goshute, and other Great Basin Native rights advocates contend the decision was the latest in a long line of historical wrongs. Among them was the massacre at Thacker Pass, known in Paiute as Peehee Mu ’huh.

It was part of the 1864–1868 Snake War, which claimed more lives than any other 19th Century Native battlefront west of the Mississippi River, according to historians. Tribes endure the legacy of the bloody skirmishing waged with colonial-settler soldiers. The aftermath led to the balkanization of ancestral lands into 28 tiny jurisdictions across Nevada.

The appeal follows a Feb. 16 lawsuit by the Reno-Sparks Indian Colony, Burns Paiute Tribe, and the Summit Lake Paiute Tribe. The plaintiffs charge that the BLM failed to engage all concerned tribal entities in government-to-government consultation during the permitting process. That would be breaking the U.S. bedrock National Environmental Protection Act and National Historic Preservation Act.

A subsidiary of Canada-based transnational Lithium Americas Corp. is set to develop “the next large-scale lithium mine” at Thacker Pass. The location contains the biggest known U.S. lithium deposit. The Lithium Nevada Corp. owners claim it has 10 times more output potential than the only operating producer in the country, Albemarle Corp. That transnational runs a brine extraction site some 300 miles to the south at its Silver Peak facility near Tonopah, Nev.

We have dozens and dozens, and dozens of other lithium projects in this state,” Great Basin Resource Watch board member Kate Berry told Buffalo’s Fire. “Thacker Pass is just the tip of the iceberg. It has become important in part because of the major cultural issues that are at stake and also all the environmental problems that are attached to it.”

Lithium America’s Corp. feasibility studies and permits place it ahead of the 20 other most advanced domestic lithium developments, mostly in the Great Basin. The corporation is gambling on filling a predicted 1 million electric vehicle orders annually to foster the mine’s success. In April 2022, LAC applied to the U.S. Energy Department for funding Thacker Pass through the Advanced Technology Vehicles Manufacturing Loan Program.

Meanwhile, General Motors’ Jan. 31 buy-in pledge for $650 million worth of shares will allow Lithium America to sever ties to its partner Ganfeng Lithium Group Co. Ltd. The transnational company based in China considers itself “the world’s largest lithium metal producer.” It holds half of LAC’s troubled lithium mine in Argentina. Chinese- and Russian-produced lithium are not eligible for U.S. credit.

“We have dozens and dozens and dozens of other lithium projects in this state, Thacker Pass is just the tip of the iceberg.”

Kate Berry, Great Basin Resource Watch board member

Banking on the proximity of Thacker Pass and the many surrounding lithium lode strikes, leading electric vehicle promoter Tesla in January announced a $3.6 million venture in Nevada. CEO Elon Musk’s brainchild will be expanding its fuel cell and heavy haul production lines at a massive “gigafactory” in Tahoe Reno Industrial Center.

Keeping company is battery supply giant Panasonic Energy of America. Scores of related enterprises share the burgeoning business park carved out of antelope and wild-horse habitat in the municipality of Sparks. Their investment returns hinge on garnering a piece of the so-called clean energy action.

With the current energy policy, the White House projects up to 4,000% more demand over the next several decades “for minerals such as lithium and graphite used in electric vehicle (EV) batteries”.

Worldwide, at least 336 new mines for graphite, lithium, nickel, and cobalt will be required to supply the electric vehicle market by 2035, according to a Benchmark Mineral Intelligence forecast. That’s even if robust materials recycling is in place: 384 otherwise.

The International Energy Agency posits 40 times more demand for lithium by 2040, given the current policy focus on replacing internal combustion passenger autos with individual electric vehicles. To meet 2035 targets for scaling down transportation’s share of emissions that way entails a 200% increase in mines around the world, Benchmark Mineral Intelligence deduces.

That increase would be “an absolute disaster for the natural world,” Protect Thacker Pass co-founder Will Falk told Buffalo’s Fire. “So, when we’re talking about saving the planet by creating electric cars, it’s just simply not something that we should entertain,” he says.

Scientific advances in alternative battery chemistry provide another hope for alleviating mining pressures, according to the Institution of Mechanical Engineers. Among emerging technologies for reducing lithium content are sodium-ion, solid-state, and lithium-sulfur batteries. All would use other minerals, however. Research and development are underway on the potential for an agricultural option in the form of hemp-based batteries.

Earthworks, a national organization that works to “ensure that the renewable energy transition does not shift burdens onto mining-impacted communities,” has pinpointed an alternative strategy. It revealed a potential for recycling to slash electric battery raw material input in 2040 by approximately 25% for lithium, 35% for cobalt and nickel, and 55% for copper.

“This creates an opportunity to significantly reduce the demand for new mining,” it says in the report Responsible Sourcing Through Demand Reduction Strategies and Recycling. However, relying on electric vehicles to help clear the air should go hand in hand with a “policy to disincentivize private car ownership and make forms of active and public transport more accessible.”

Talli Nauman

Contributing Editor

Location: Spearfish, South Dakota

Spoken Languages: English, Spanish

Topic Expertise: Climate, Environmental and Social Justice; Right to know; Spearfish, South Dakota

See the journalist pagehttps://www.msci.com/www/blog-posts/mining-energy-transition-metals/02531033947

https://westernwatersheds.org/wp-content/uploads/2023/02/Emergency-Mot-for-Injunction-Pending-Appeal_FILED-2.21.23.pdf

https://www.buffalosfire.com/tribes-say-no-to-lithium-mining-at-nevada-massacre-site-2/

https://www.benchmarkminerals.com/

© Buffalo's Fire. All rights reserved.

This article is not included in our Story Share & Care selection.The content may only be reproduced with permission from the Indigenous Media Freedom Alliance. Please see our content sharing guidelines.

Identification not yet made

UTTC International Powwow attendees share their rules for a fun and considerate event

Radio collaboration highlights importance of cooperation in a season of funding cuts for local media

A memorial in the Snow County Prison, now the United Tribes Technical College campus

Standing Rock Sioux Tribal Chairwoman Janet Alkire tells crowd, ‘We’re going to rely on each other’